22 February 2019 — Stories

By Vita Ramanauskaité and Eleni Kanelli

This is the second blog of our sustainable finance series. Read our first blogpost Sustainable finance: what’s it got to do with accountants? to know how accountants’ daily work contributes to a sustainable economic growth.

Our environment is in crisis, and we have ignored it for too long. We are now pressed to radically change the way we live and do business.

Business has brought us here, as markets have ignored environmental or social costs to pursue profit. But business can also help get us out, by driving markets towards more sustainable practices.

Accountants are part of the solution. They can help companies make the right changes to reduce their environmental footprint – and costs. Together, we can harness corporate power to make the necessary shift to a sustainable economy.

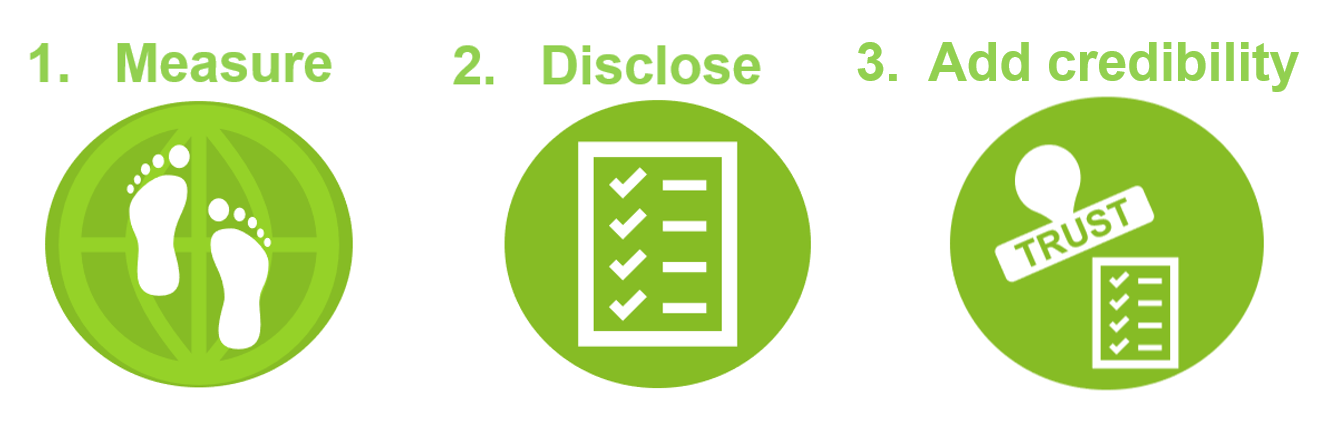

Businesses must change their benchmarks for success if they want to be sustainable in the long run. Accountants can make a real difference by: measuring impacts, disclosing information, and add credibility to what is reported.

Businesses must change their benchmarks for success if they want to be sustainable in the long run. Accountants can make a real difference by: measuring impacts, disclosing information, and add credibility to what is reported.

Companies must measure more than financial performance; they must also properly measure the environmental and social impact of their economic activities. These measurements are aimed at supporting action and decisions, they shouldn’t be regarded as just a compliance exercise.

Measurements must be based on an appropriate methodology and professional judgement. Products and services must undergo science-based life cycle impact assessments, such as farm-to-fork , on what damage is being incurred where.

We also need to measure the same things in the same ways. This means moving towards global standards for sustainability, as has been successfully done for financial reporting with the IFRS.

Accountants are in the business of measuring and they already have a long standing experience of how these measurements can be done. Disclosing these measurement enhances their decision-making value. This is done by expanding corporate reporting to include non-financial aspects.

Transparency is key here. Today, technology enables greater transparency than ever. Further, it is no longer possible for a company to control all of the information . Companies should understand that it is more cost-efficient to disclose information, even bad news, themselves rather than having it disclosed by others.

Reported information needs to encompass not only historic financial data, but also ESG and forward-looking information over the short, medium and long term. And the information needs to be integrated so that business decisions are taken on a holistic basis, with all aspects and impacts considered.

Here too, the accountancy profession has solid experience to report on sustainability data as well.

Trust is the foundation of markets and societies. But greenwashing undermines that trust. Financial and non-financial information such as environmental records of companies need to be reliable and trustworthy to enable investors and other stakeholders make the right decisions.

It is therefore important to have an independent expert opinion on the process used to collect and analyse the data; and to verify how accurate and exhaustive the data reported is.

In all human collective endeavours, delivery and progress have always depended on measurement, transparency and trust. This is why accountants have a key role to play in the challenge of reversing climate change.

In our next blog on sustainability, we will go into the steps that accountants can take to help companies to become more sustainable.