10 October 2018 — Stories

By Vita Ramanauskaité and Eleni Kanelli

This is the first blog post of our sustainable finance series. Check out the second part here: Radical change to fight our environmental crisis

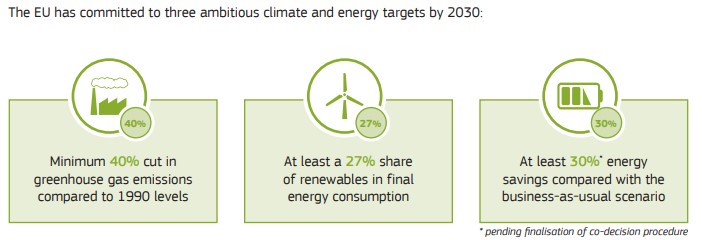

To keep Europe liveable for all 512 million of us, we will need a more sustainable economy. Having committed to the UN Sustainable Development Goals and the Paris Climate Agreement, Europe needs to fulfil an ambitious agenda by 2030. To this end, the EU launched a massive Sustainable Finance initiative to stimulate the €180 billion annual investment needed to merely achieve its energy and climate goals. This is part of the EU’s legislative efforts to establish a Capital Markets Union to which Accountancy Europe has steadily contributed.

Source: https://ec.europa.eu/info/files/180524-sustainable-finance-factsheet_en

Source: https://ec.europa.eu/info/files/180524-sustainable-finance-factsheet_en

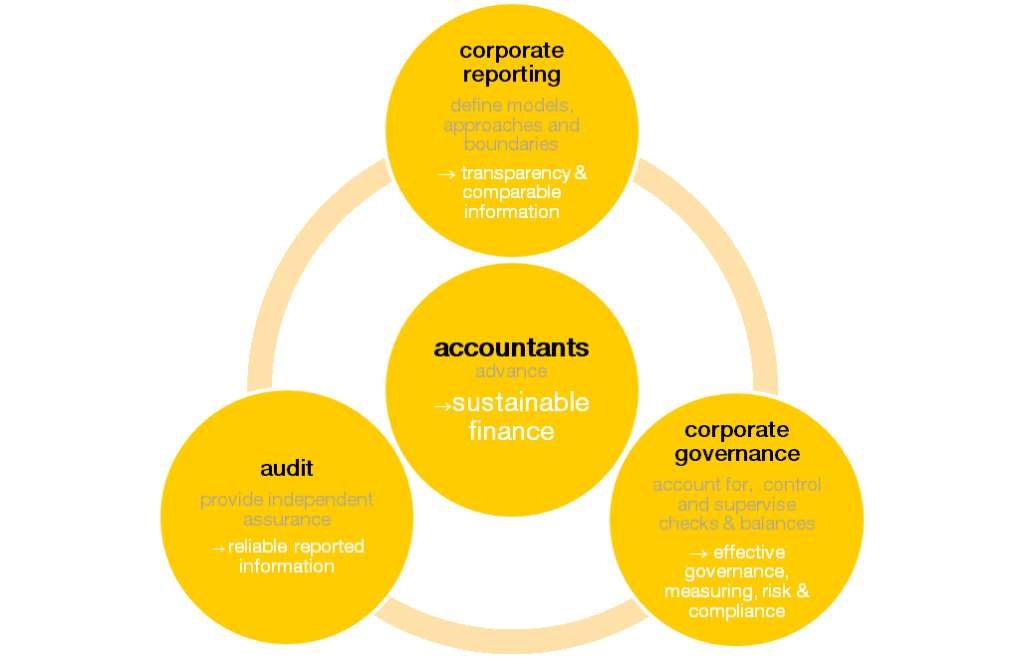

Accountants provide transparency that is essential for the stability of Europe’s financial system and for moving from short-term investments to sustainable economic growth. What gets measured gets done, so accounting is a natural starting point. Measuring pollution, resource depletion and global warming will correct market failures, and this will drive a truly sustainable economy and should deter ‘greenwashing’. Businesses also perform better when they report on sustainability matters; they are more likely to identify long-term risks and build resilience into their business models.

Accountants contribute via their daily work in 3 primary ways:

We have continuously advocated financing sustainable growth and supported long term investments for the past two decades. Next to our recent publication Sustainable finance. The accountancy profession’s contributions to EU strategy and our contributions on the Capital Markets Union, we have worked extensively on the following topics: