This document was updated on 14 January 2021.

The United Kingdom (UK) left the European Union’s (EU) single market on 1 January 2021. The Trade and Cooperation Agreement (TCA) was agreed on 24 December but many detailed aspects of Brexit remain unclear. However, from that date, the UK becomes as far as the EU is concerned a ‘third country’. Businesses have become importers and exporters between the EU and the UK and they need to take urgent action to minimise the disruption to their business.

Accountants are instrumental in helping their clients make the necessary plans, so it is important that accountancy bodies make their members aware of the fundamental changes in the way trade will take place, to better advise their clients.

This Q&A provides practical information on the main changes known at mid-January 2021. It is not a comprehensive document.

EU-UK trade changed significantly from 1 January 2021, and will change again for e-commerce from 1 July 2021. Businesses should take the following main actions:

Accountants with clients who engage in trade between the EU and the UK, and vice versa, should further research the technicalities and are strongly advised to contact their relevant clients as soon as possible to discuss their specific circumstances. Unrepresented businesses are strongly advised to take specialist advice to ensure the continuity of their business.

We have also highlighted some of the changes that could occur as a result of Brexit in respect of other taxes. The impacts of these often depend on the provisions of double tax treaties between the UK and individual EU Member States and specialist advice should be sought. Brexit & direct taxes is available on this page.

Question 1: A trade deal between the UK and the EU has been agreed and adopted before 1 January 2021. No tariffs are charged on the supply of non-excise goods. Surely, I have nothing to worry about?

Answer: Absolutely not! The TCA has removed the possibility of general quotas and other restrictions on the importation of goods. It has also prohibited tariffs on some imports between the UK and the EU – but only in certain circumstances and with the correct documentation.

The TCA covers very little in the way of the provision of services between the EU and the UK, apart from some basic principles and a commitment to further examine cooperation in this area. Substantial uncertainties remain in areas ranging from the ability of financial services providers to provide their services in the other party’s territory(ies), to the mutual recognition of qualifications and regulatory standards.

In respect of accounting for VAT, and the requirements for customs clearance of goods, there are significant changes – the details of most of which are already known.

Businesses must urgently review their processes to be sure that they are ready for the changes that took effect on 1 January 2021. Failure to provide the correct paperwork is likely to result in shipments being delayed at borders, and possible fines (for example, for failing to obtain a Kent Access Permit).

Question 2: Does it make any difference if I am a UK business selling into the EU or an EU business selling into the UK?

Answer: Not really. The changes are broadly equivalent on both the EU and UK sides. The main difference is that there is more certainty in respect of the procedures (and custom tariff rates) in the EU because these are already fully established. However, there is significant variation in procedures and rates of VAT across the 27 Member States, so UK exporters importing into the EU will, depending on their terms of trade, need to acquaint themselves with the local rules of each Member State into which they make supplies.

Also, there is currently a critical distinction in respect of supplies of goods made between Northern Ireland and the EU (and vice versa) and the rest of the UK (for the purpose of this document, subsequently referred to as ‘Great Britain’ – GB). We will look at this issue in more detail below.

Question 3: I sell goods between the EU and GB. What changed for me from the 1 January?

Answer: Such supplies ceased to be intra-EU supplies. Consequently, they are treated as exports from the country of dispatch and imports in the country of arrival. This has important implications for VAT, customs and excise duties. It also impacts on other regulatory requirements that will have to be met for goods, such as those subject to health checks (for food, medicines, live animals, etc), chemicals, medicines, weapons, and dual-purpose goods.

The goods leaving the country are treated as exports. This means that they are exemptzero rated from VAT – so no output VAT will be charged on the supply of goods. You must, however, be able to provide proof that the goods have left the EU, or GB for exports to the EU.

Different rules apply to Northern Ireland – EU supplies of goods and to Northern Ireland – GB supply of goods (See below).

The goods entering GB for supplies to the EU and for supplies from the EU to the UK are treated as an import. VAT will have to be charged at the local rate of VAT of the country of import for that type of good. A searchable ‘Taxes in Europe’ database has been developed for EU Member States, which shows Member States’ VAT rates for specified goods.

Question 4: Who accounts for and pays the VAT?

Answer: That depends on the terms of business, who is identified as the importer and who receives the goods.

General guidance is available here (in respect of where to tax) and here (in respect of who is liable to pay the tax).

If your organisation imports for your its own use – in manufacturing or for resale for example – then you are liable to register for VAT in the country of import and account for the import VAT under the local VAT reporting requirements.

If you make distance sale of goods, the situation is more complex.

If you make B2B supplies, then your customer would normally be expected to account for the VAT on import, which would be charged by customs at the point of import.

If you make B2C supplies of goods, you have the choice as to whether your business terms provide that you will deal with the customs duty and import VAT yourself (‘Delivered Duty Paid – DDP’) and thereby price the goods to include these costs. With DDP, you would be required to register and pay the VAT in the country of the customer- andor use an agent.

Alternatively, you could opt for ‘Delivered at Place’ (DAP) – where only the net price and delivery costs would be shown, and the customer would be liable to pay the VAT and customs duty. This would typically be collected by the courier or national postal service and goods would be withheld until payment is received. It is possible that in some Member States the national postal service will pay the import VAT and reinvoice the supplier.

The rules are complicated and specialist advice should be sought.

Question 5: You mentioned distance sales. I thought I only had to register in other countries if I made a lot of sales there?

Answer: The national exemption thresholds for distance sales of goods only cover sales between two Member States to non-VAT identified customers in the second EU Member State. Therefore, from 1 January 2021 this simplification regime does not apply for EU-GB sales and GB-EU sales.

You must then choose whether to use the DAP or the DDP terms described in Question 4. If they chose DAP then the VAT would normally be paid at the point of import by the customs declarant (e.g. the courier, postal operator or by a customs agent) and then recovered from the customer before the goods are handed over.

If the DDP method is chosen, an EU supplier must register with HM Revenue and Customs and declare and pay VAT for distance supplies made to the UK. Simplification procedures will be available for small value consignments (see Question 6 below).

GB suppliers making distance sale of goods under DDP into the EU will normally be required to register for VAT in each Member State into which they make supplies of goods originating outside the EU. Currently, there is no exemption threshold for non-EU established businesses and EU Member State local registration and reporting requirements differ greatly. For example, many EU Member States require that 3rd country suppliers (i.e. non-EU registered businesses) formally appoint a tax representative that will have joint and severable liability for any unpaid VAT. One example of this is France, as shown in this article.

Question 6: But I only sell small items through a sales platform. Surely, I don’t have to worry about this?

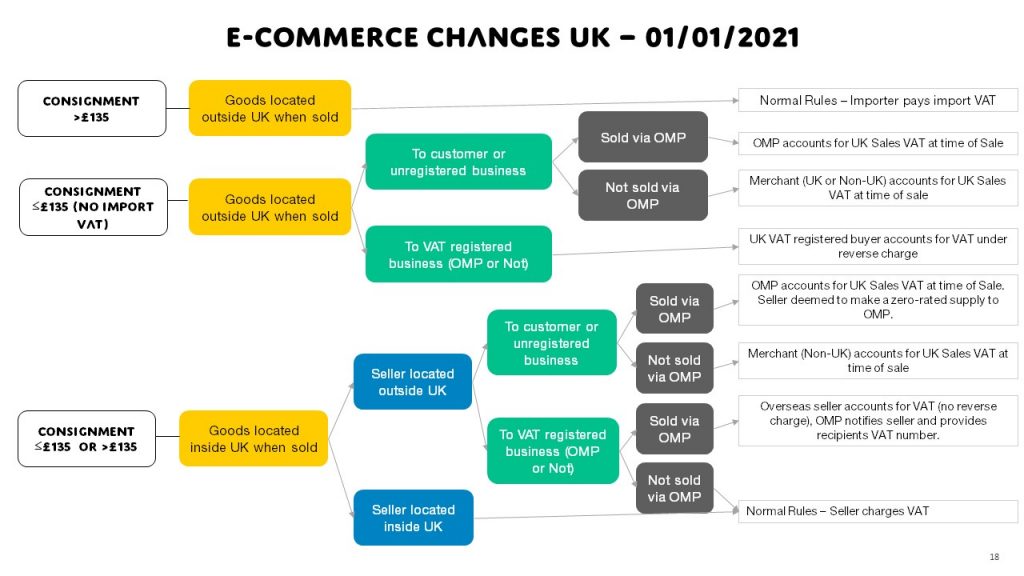

Answer: Unfortunately, you do. There are big changes in both the UK and the EU in 2021 in respect of distance selling to consumers of low value items. The changes are similar, but the timing is not – the changes applied in the UK from 1 January 2021 and will apply from 1 July 2021 in the EU.

On 1 January 2021 the UK’s low value consignments exemption for goods not exceeding £15 in value was withdrawn. This will make all imports subject to import VAT (and potentially customs duties). At the same time, a small consignment import simplification process is in place and online marketplaces (OMPs) must account for VAT on behalf of suppliers that use their platforms.

A simplification is available from 1 January 2021 for low value consignments where the total value of the goods (not the individual value of each item) does not exceed £135, excluding shipping costs and duty. EU suppliers must register with HM Revenue and Customs and charge VAT at UK rates at the point of sale and then account for the VAT using normal VAT return procedures. The goods will then not be delayed by the requirement for VAT to be charged by customs at the point of entry.

If such goods are sold via an OMP, it is the OMP that would account for VAT at the point of sale.

The options for e-commerce sellers from GB to the EU, and how the changing roles that the OMPs will play in this, are shown in the graphic below:

Source: ICAEW

This is a complex area and specialist advice should be sought as soon as possible.

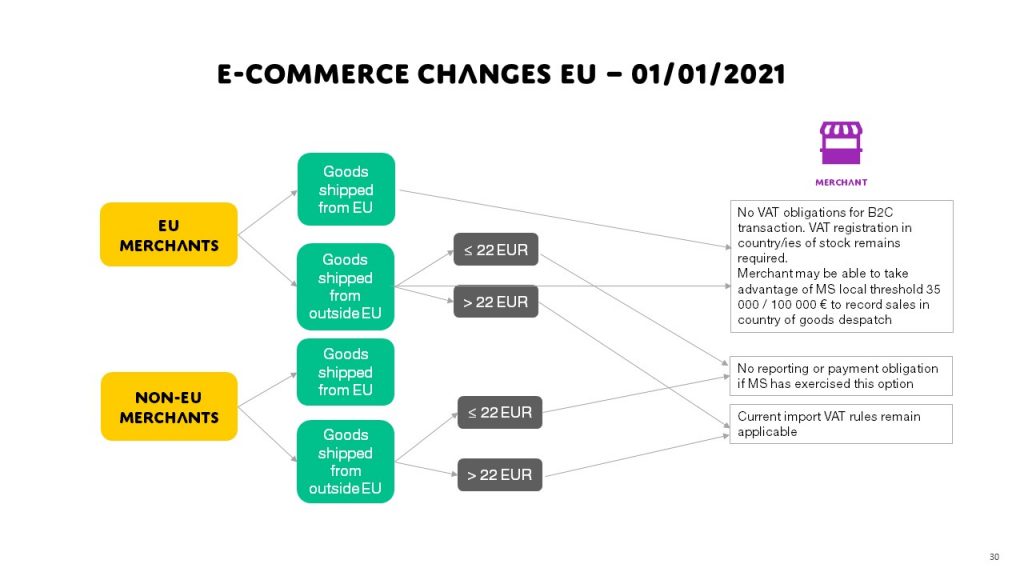

Very similar measures will be introduced in the EU but have been postponed until 1 July to allow for delays caused by the Coronavirus crisis.

This means that where Member States have adopted this option, the EU’s €22 exemption will be maintained until 1 July 2021 (note that not all Member States have adopted the maximum threshold, which is, for example €1 in France €17.05 in Cyprus, DK80 in Denmark and €nil in Sweden).

However, all other distance sales of goods from GB into the EU will be subject to import VAT from 1 January in the Member State where the good are imported into. Consequently, GB suppliers will have to register and account for VAT in each Member State where they make distance supplies. The different ways with which e-commerce imports into EU Member States are accounted for, for VAT purposes, between 1 January and 30 June 2021 are shown below.

Source; ICAEW

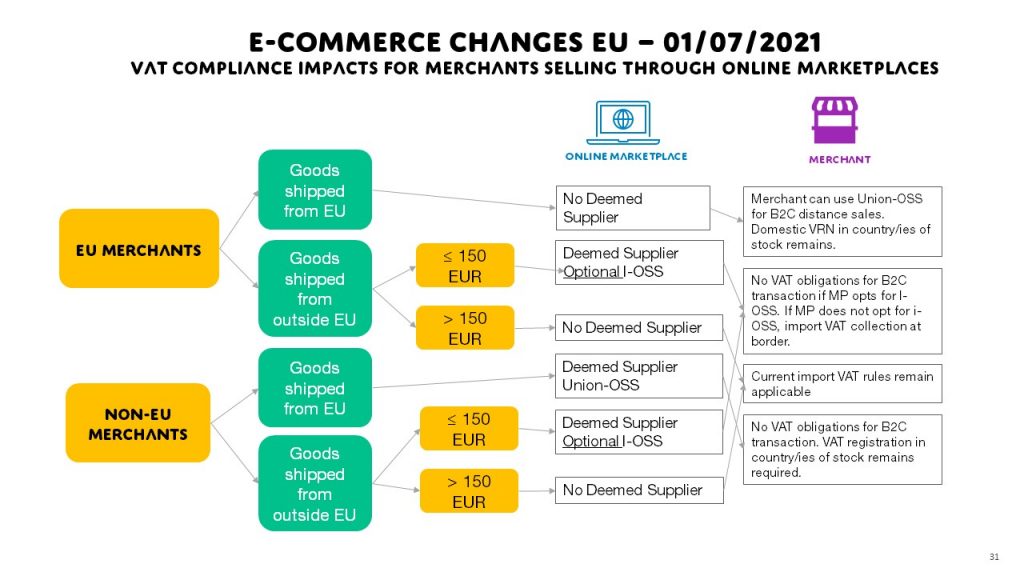

From 1 July 2021 the simplified procedures for low value consignments come into effect in the EU for consignments with a total value of up no more than €150. These mirror the simplifications that the UK introduced on 1 January 2021, with the important addition of the ability in the EU to use the import One Stop Shop (IOSS).

From this date GB businesses can choose a single EU Member State of Identification and then use the IOSS to make a single return of all small value consignment distance supplies of to each Member State.

Additionally, the EU’s rules on the distance sales facilitated through an online platform will come into effect on 1 July. However, in the intervening period, you may not be able to rely on your digitalised sales platforms to deal with the necessary formalities. Indeed, Amazon have already confirmed that they will not allow cross-channel sales from Fulfilment By Amazon (FBA). Cross-channel traders will be required to transfer goods to a fulfilment centre in the UK or EU as relevant – which after 1 January 2021 has VAT and customs duty consequences for the supplier. The options for e-commerce sellers from GB to the EU, and how the changing roles that the OMPs will play in this, are shown in the graphic below:

Source: ICAEW

Again, this is a very complex subject and expert advice should be sought to deal with your individual circumstances.

Question 7: You can’t always assume that customers will receive their goods by the expected date. What happens if goods were in transit on 1 January 2020?

Answer: Any EU-UK supplies made on or before 31 December will be treated as intra-EU supplies until 31 March 2021. Consequently, they will follow the current intra-EU supplies VAT and duty treatment. However, it is possible that some goods may be stopped at Customs until the supplier is able to demonstrate that the despatch of the goods took place before 1 January 2021.

Question 8: I’m lucky. I only sell digital services and we already have the Mini-One-Stop Shop (MOSS). Surely, nothing changes for me?

Answer: Yes, it does. If you are a UK established supplier of digital services selling to non-VAT registered customers in the EU you will still be able to use the Mini-One-Stop Shop to make your return filing.

However, from 1 January 2021 the £8 818 (€10 000) threshold disappeared for supplies of digital services between the UK and EU non-VAT registered customers. UK suppliers must register in a single EU Member State and use the Mini One-Stop Shop (or else register in every EU Member State where the clients are established) for digital services to declare all of the EU sales, and the VAT thereon.

For EU businesses selling digital services into both UK and the EU, you will be able to use the MOSS for EU supplies but for UK supplies you must register in the UK and declare your sales to HMRC – you can no longer use the MOSS for these supplies from 1 January 2021.

Question 9: I have a complex supply chain that involves movements of goods between the UK and EU. Is there anything else I should be concerned about?

Answer: Almost certainly, but the impact will depend on your business model and the nature and scale of your cross-border supplies.

In the short-term at least, EU and UK VAT legislation will remain reasonably aligned (although Member State options already mean that there are considerable differences between Member States local VAT rules) but may well diverge in the future (e.g. in respect of financial services). However, even before the rules diverge further there will be practical issues to deal with – especially in respect of access to EU systems and to simplifications directly related to intra-EU supplies of goods. As an indication, we can consider the Quick Fixes that came into effect from the 1 January 2020.

Non-established suppliers will be able to use the call-off stock simplification after Brexit, as can be seen from this Explanatory Note from the European Commission, section 2.5.25. However, in respect of chain transactions, section 3.6.2, this simplification will only apply to intra-EU movements of goods so movements of goods from 3rd countries must make use of other simplifications, if available (or else be VAT registered in an EU Member State).

Question 10: If I incur input VAT in respect of EU-GB supplies but am not required, and have not chosen to, register in the country where the VAT was incurred, will I still be able to recover it after 31 December.

Answer: Yes. However, for supplies made after 31 December the claim for refund must be made directly to the authorities of the country concerned, providing that there is a reciprocity agreement. Such claims cannot then be made through the electronic refund claim system.

The one exception to this rule being in respect of goods or services supplied up to 31 December 2020. In such cases the electronic system can be used by all UK and EU businesses until 31 March 2021 to recover the VAT incurred in 2020.

Question 11: I have not had to worry about import duty for EU-GB transactions before. What is going to be the impact on me?

Answer: The TCA introduced a prohibition on the imposition of tariffs on the supply of goods originating in either the EU or UK and supplied into the territory to the other party. However, the ‘preferential tariff treatment’ is not automatic and must be claimed – either at the time of importation via the customs import documentation or, by derogation, retrospectively for up to three years after the date of importation.

The origin of the product is critical in determining whether the preferential tariff treatment will apply. The general principles will be considered in further detail under the Import Tariffs section below.

Cross-channel suppliers must take some urgent administrative steps:

As mentioned, for the supply of goods originating in the EU or the UK to the territories of the other party, there is the possibility of a preferential tariff treatment (zero tariffs). Import tariffs will apply on the WTO most favoured nation basis if:

The UK applied its own import tariffs from 1 January 2021, which are not the same as EU tariffs. The UK tariffs can be found here. The UK Global Import Tariff essentially reduces the overall duty payable on imports compared to the current EU Tariff Free Lines (i.e. UK 47%, EU 27%; Average Duty rate UK 5.7%, EU 7.2%).

From 1 January 2021, importers of non-controlled goods into the UK are subject to basic customs requirements and can delay their supplementary customs declarations until July 2021. They can also defer submitting confirmation of the goods’ origin to claim the preferential tariff treatment until this date. For importers using this delayed filing, the payment of duties and VAT can be delayed to the time when the supplementary declaration is submitted. Full customs procedures are required from 1 January 2021 in respect of controlled goods – e.g. alcohol and tobacco products.

From 1 January 2021, goods brought into the EU from the UK are subject to full customs procedures. This means customs formalities will have to be observed at importation of the first EU country at which the goods arrive.

Duty suspension will no longer automatically be available – excise duties and VAT are due at the point of importation. Documents required to establish the origin of the goods will be required at the point of importation if the supplier wishes to claim the preferential tariff treatment immediately.

From 1 January 2021 UK economic operators can no longer use the EU’s Excise Movement and Control System (EMCS) for imports of controlled goods into the EU from Great Britain.

Rules of Origin for the supply of goods

Correct understanding and implementation of these rules is essential if the preferential tariff treatment is to be successfully claimed. The rules are strict and complicated and require supporting documentation to be maintained.

Fundamentally, to benefit under the TCA goods must meet the EU-UK preferential rules of origin. Generally, these will apply when the goods have been:

‘Substantially transformed’ requires a considerable element of operation on the product. There is a list in Article ORIG.7 of processes that are insufficient to be accounted as substantial transformation. These include labelling and simple packaging, simple mixing of products, simple assembly of parts etc. In this context, ‘simple’ means that neither specialist equipment nor skills are required for the operation.

Within the Product Specific Rules there are specific tolerances that permit some non-originating elements in determining local origin for the final product. For certain products this is based on weight (i.e. under 15% non-originating material) or by value (i.e. under 10% of value added can come from non-originating products), with amendments to these rules for textiles.

Once a product has gained originating status, for example by substantial transformation in accordance with the relevant Product Specific Rule, it would henceforth be considered as fully originating and the non-originating element disregarded.

Suppliers are required to segregate good, physically or by accounting procedures, products that originate from their territory from those that do not.

Question 12: I move goods between the EU and Northern Ireland and, sometimes, on to Great Britain. What will change for me?

Answer: Under the Withdrawal Agreement, Northern Ireland remains part of the EU Single Market until at least 31 December 2024, with the possibility for the Northern Ireland Assembly to extend this period.

Consequently, supplies of goods (not services) between Northern Ireland and the EU Member States from the 1 January 2021 continue as intra-EU supplies, with economic operators having to use the EMCS and SEED systems for all movements, and the EU online refund mechanism still being available. Equally, current reporting requirements such as Intrastat and EU Sales Lists (ESL) continue.

Movements of goods from Northern Ireland to Great Britain and vice versa are treated as exports and imports respectively. Consequently, the impacts will be the same as those discussed previously for movements of goods directly between Great Britain and the EU Member States, including the rules of origin.

The latest HM Government advice for moving goods under the Northern Ireland protocol can be found here.

Question 13: I supply services between the UK and the EU. How will this impact me?

Answer: Free trade agreements concentrate on supplies of goods, rather than services (albeit there is the WTO General Agreement on Trade in Services (GATS)). Consequently, there are significant changes in how supplies of services cross-channel are accounted for VAT purposes.

The TCA contains provisions in respect of the mutual recognition of lawyer qualifications (when performing certain services) but otherwise contains no agreement on the mutual recognition of professional qualifications. Without this, it may not be legal for a service provider in a regulated profession (i.e. medical, accountancy, architectural) to provide cross-channel services – and this can depend on the national rules of the specific country where the services are to be conducted.

The degree to which you may be affected can be gauged by using the European Commission’s regulated professions database.

For non-regulated professions, there are provisions to ensure a liberalised market for services provided from the EU to the UK, and vice versa. Visa-free business trips are permitted of up to 90 days in any 180-day period.

Question 14: OK. I am not practicing in a regulated profession. How will the rules change for me after 1 January?

Answer: The current EU VAT legislation is already quite complex in respect of the determination of place of supply of services, which can depend on factors, such as the nature of the service, whether the recipient of the service is a taxable person, where the service is performed etc.

Where the current rules indicate that the service is ‘supplied’ in another country, the supply will be subject to VAT in that country. Consequently, if, for example, the place of supply is deemed to be in a Member State for services provided by a taxable person based in the UK, it would be an outside the scope of VAT supply in the UK (zero-rating) and taxable in the Member State where the place of supply of the service is located.

The reverse would apply for an EU taxable person making supplies of services where the place of supply was the UK.

B2B supplies of services are situated where the customer is established. As a rule, the customer will be liable for the payment due of VAT in the country where they are established. There are, however, exceptions to this rule.

B2C supplies of services are generally situated where the supplier is established so consequently a VAT liability will be incurred in the country where the supplier is established.

However, the place of supply rules for services are complex and expert advice should be taken.

As with the supply of goods, there will be many specific circumstances where the end of the transitional period could result in uncertainties and issues for specific business models.

For example, Art 59a of the VAT Directive permits Member States to override the normal place of supply rules if the effective use and enjoyment of these services takes place outside the EU despite being performed in their Member State, and vice versa. This is a measure to prevent double taxation, or non-taxation, and is often used by Member States to tax services that would otherwise be out of scope of VAT. If EU Member States were to apply this to certain supplies made by suppliers established in the UK, or vice versa, there could be issues in respect of recovering VAT already paid – thereby leading to double taxation and the question of how this double taxation could be recovered.

Question 15: What should I do next?

Answer: If you make EU-UK supplies or have a supply chain that relies on EU-UK deliveries, you should immediately assess the risks to your business and make the necessary registrations. A useful checklist can be found here.

With the late agreement of the TCA there will still be many businesses that haven’t prepared for the changes and there will be further pressure to effect VAT and customs registrations and obtain tax advice. If you leave it too late you may find that you are unable to obtain the necessary authorisations and registrations for some time, leading to additional business disruption.

Specialised businesses (for example, those requiring licenses or those with complex supply chains) should take expert advice as soon as possible. This is especially the case for the complex rules on origin, which may require businesses to make structural changes as to where they source, distribute or even manufacture goods in order to deal with the issues.

Getting this wrong, or doing nothing, could be very costly. For example, hauliers are already refusing to collect goods from some businesses who may not have implemented the necessary processes – as one package without the correct documentation can prevent the entire consignment clearing customs.

In the longer term, it will be necessary to monitor the legislative developments in both the EU and the UK to identify new divergencies between the two VAT systems and the practical issues that these may cause.

By virtue of the UK’s Taxation (Cross-border Trade) Act 2018, on 1 January 2021 the UK’s VAT rules effectively remained largely aligned with those of the European Union, to avoid any cliff edge effect on that date. At the same time, this Act adapts UK law to remove, for example, in relation to Great Britain, the concepts of intra-EU acquisitions of goods as they become imports from 1 January 2021.

Over time though, we could see divergence in areas such as the VAT treatment of financial services (the UK government recently announced that UK financial services businesses will be able to recover input VAT in respect of supplies made to the EU), VAT groups, and partial exemption, for example.

Currently there is no clear indication of what such changes will be, or when they will occur.