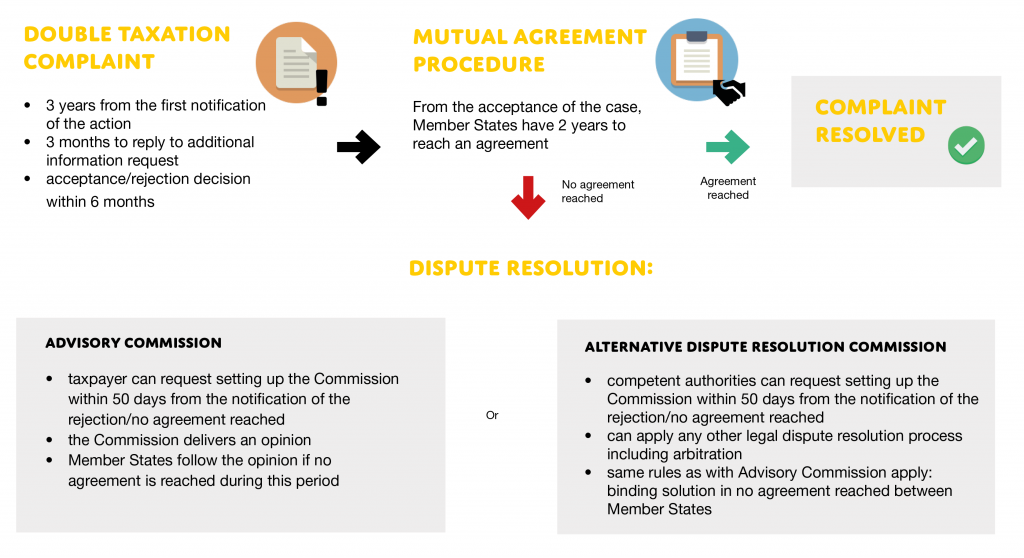

On 1 July 2019, the EU’s Directive on tax dispute resolution (2017/1852) entered into force. The Directive sets up a new process for the resolution of tax disputes in the EU. Both Member States and taxpayers have new obligations and opportunities under this legislation.

Accountants, auditors and advisors should be prepared to support businesses in going through this procedure and ensure an efficient and fair outcome in double tax cases.

This factsheet gives an overview of the new Directive’s main provisions focusing on what the taxpayer must do. It aims to equip European accountants with the knowledge that will enable them to help taxpayer clients deal with double tax disputes, by navigating through the new rules.