The coronavirus (SARS-CoV-19) pandemic continues to spread in many countries, including in Europe. The World Health Organization (link is external) (WHO) and national authorities can be consulted for the health implications on people. This crisis also has significant economic effects on companies, for example due to restrictions in production, trade and consumption or due to travel bans.

These economic effects have an impact on accounting, reporting and auditing financial statements of the companies or groups concerned. This publication highlights some of these potential implications. However, the impact on companies will differ and companies, and their auditors, have to consider how it affects their business and review them regularly. The further development, duration and impact of the coronavirus cannot be predicted. In any case, accountants and auditors should remind companies of the various national initiatives for relief to companies.

Below we explore coronavirus’ effects on:

Reporting standards like International Accounting Standard (IAS), International Financial Reporting Standards (IFRS) and relevant national Generally Accepted Accounting Principles (GAAP) should be fully complied with. In addition, companies should consider going beyond them to respond to their actual accounting and reporting challenges caused by the coronavirus in a sensible and practical way.

Reflecting conditions which existed at the balance sheet date

As at 31 December 2019, China had alerted the World Health Organisation (WHO) of several cases of an unusual form of pneumonia in Wuhan. However, substantive information about what has now been identified as coronavirus only came to light in early 2020.

Going concern

Companies adversely affected by the coronavirus, for example small businesses or those in the areas of travel, leisure & hospitality and aviation, need to consider going concern issues. They need to consider running several possible sensitivity analyses to determine whether there is any material uncertainty on its ability to continue as a going concern. This can result in additional disclosures especially if there is a material uncertainty. In some circumstances it may be necessary to consider whether it is appropriate to prepare the accounts on a going concern basis. For this, the company should consider all available information about the impact on future trading. Regarding the timeframe, one needs to consider at least the first twelve months after the balance sheet date, or after the date the financial statements will be signed. But a longer timeframe is advisable. This going concern assessment should be continuously updated to the date the financial statements are approved.

Non-adjusting post balance sheet events

The general requirement is that the balance sheet reflects the position at the end of the reporting period. Therefore, for companies in Europe with a 31 December 2019 year-end, the emergence of coronavirus is a non-adjusting event, since the outbreak occurred midst of January 2020.

The nature of any material non-adjusting event and an estimate of its financial effect must be disclosed by way of note. Therefore, companies need to consider the impact of the coronavirus on their business, which will vary according to the specific circumstances in which it operates. This includes that the disclosures articulate potential impact in the next reporting period.

Further disclosures in the management report

Companies should also consider whether to refer to the possible impact of coronavirus when they report principal risks and uncertainties in the management report. In principle, they should report this when possible further developments can lead to negative deviations from the company’s forecasts.

Post balance sheet review period

‘Events after the end of the reporting period’ include all events up to the date when the financial statements are authorised for issue. It is important to incorporate a comprehensive post balance sheet review in the year-end reporting plan.

As we progress through 2020, more information is coming to light on the scale and impact of coronavirus. There may be a greater degree of judgement required when identifying the conditions at balance sheet dates after 2019, and therefore assessing whether the developments are adjusting or non-adjusting events. The coronavirus is ordinarily an adjusting event for any reporting period ending as from 31 January 2020.

Companies will need to review, in addition to going concern, all areas of the accounts that are subject to judgement and estimation uncertainty, including:

The impact of breaches of covenants, onerous contracts provisions and restructuring plans also deserve consideration.

Compliance with International Standards in Auditing (ISAs) should continue in full, even under pressure of changed timelines. In addition, auditors should step back and consider looking further to respond to the particular auditing challenges that the coronavirus’ causes for companies and their reporting.

Coronavirus’ impact on an auditor’s risk assessment of a company

The auditor’s risk assessment, and whether this needs to be revised because of the threat of new significant risks, for instance the company’s liquidity. As the current situation is very fluid, it will need to be constantly reconsidered during the audit. Further guidance can be found in ISA 315 Identifying and assessing the risks of material misstatement.

Obtaining audit evidence

Auditors should consider how to gather sufficient appropriate audit evidence. In this, auditors should recognise that they may need to change the audit approach and develop alternative procedures, particularly in group audit engagements with subsidiaries to which access is restricted. This continues to be required to be able to report or consider modifying the audit opinion. The auditor should envisage the greater use of technology in sharing data or hosting virtual meetings. ISA 500 Audit Evidence provides further details.

Implications for the auditor’s assessment of going concern

This will undoubtedly be a key focus of many current and forthcoming audits given that uncertainty about the global economy and the immediate outlook for many companies has increased. ISA 570 on Going Concern remains applicable.

For example, management’s assessment of going concern may need to include:

The impact of the company’s future prospects on the auditor’s report

The auditor should consider the difficulties that management may have in preparing future projections, recognising the highly uncertain and fluid situation. Indeed, such projections could change significantly in a short space of time. It’s essential for the auditor to use professional judgement and scepticism. They need to exercise care to ensure that any projections reflect the situation as, and when, an audit report is to be signed. See ISA 560 Subsequent events for further details.

Consider the adequacy of management’s disclosures about coronavirus’ impact

The auditor needs ensure that management’s disclosures appropriately describe the company’s prospects and how financial statements’ users might be affected. This all while recognising the current high degree of uncertainty. Auditors need to also consider their responsibilities in relation to other information presented by management with the financial statements. This is covered in ISA 720 The auditor’s responsibilities related to other information.

Potential effects on the auditor’s report

The implications for the auditor’s report may include[2]:

Auditors’ proactive discussions with their client companies

Auditors are advised to be proactive and discuss with their clients the impact of the coronavirus on the company, its business, operations, reporting timetable and the related audit timetable, including their respective contingency plans. There is a risk of delays because the company can be interrupted in preparing information.

Logistical issues in preparing accounts and undertaking audits

Some companies and auditors are facing practical difficulties in preparing accounts and carrying out audits. This is likely to affect how audit firms will audit those companies. Given increasingly restricted travel, meetings and access to company sites, auditors need to develop alternative audit procedures to gather sufficient appropriate audit evidence.

Group audit review considerations

Group auditors need to consider how they plan to review component auditors’ work to meet the standards’ requirements. This should include considering whether alternative procedures should be used, for example, where travel is restricted.

Unforeseen circumstances

When the audit cannot be performed at all, for instance because of confinement or the signing auditor becomes ill, it is recommended to also contact the relevant regulator for advice on next steps.

Coronavirus resources for European accountants from our Member Bodies, regulators, firms and others can be found on on our online hub. Further coronavirus related content from Accountancy Europe is available here.

[1] For instance, revenue recognition; inventories; income taxes; property, plant and equipment; investments in associates and joint ventures; provisions contingent liabilities, etc.

[2] The following ISAs are relevant:

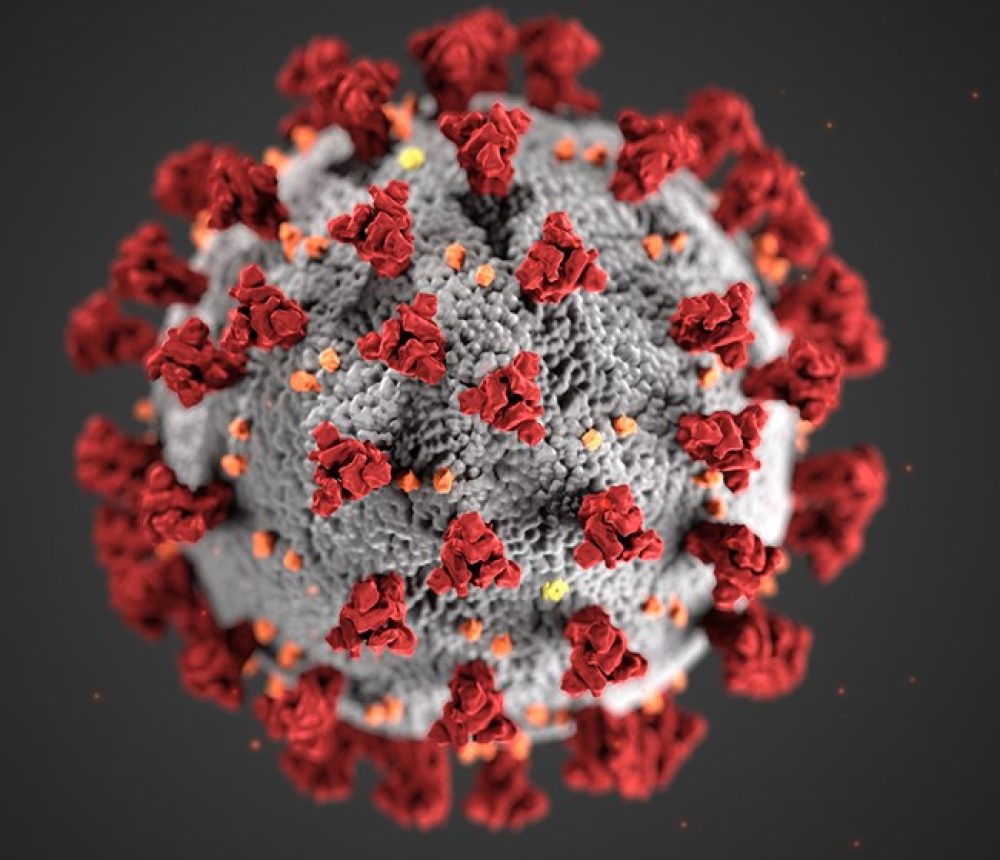

Photo credit: CDC/Alissa Eckert, MS; Dan Higgins, MAMS