Digitalisation is happening. But how it will impact the accountancy profession?

Our Digital Day 2018 provided the audience with insight on how to make opportunities out of technology. We believe the technological revolution can help you deliver more value to businesses and society. So, are you up for the challenge?

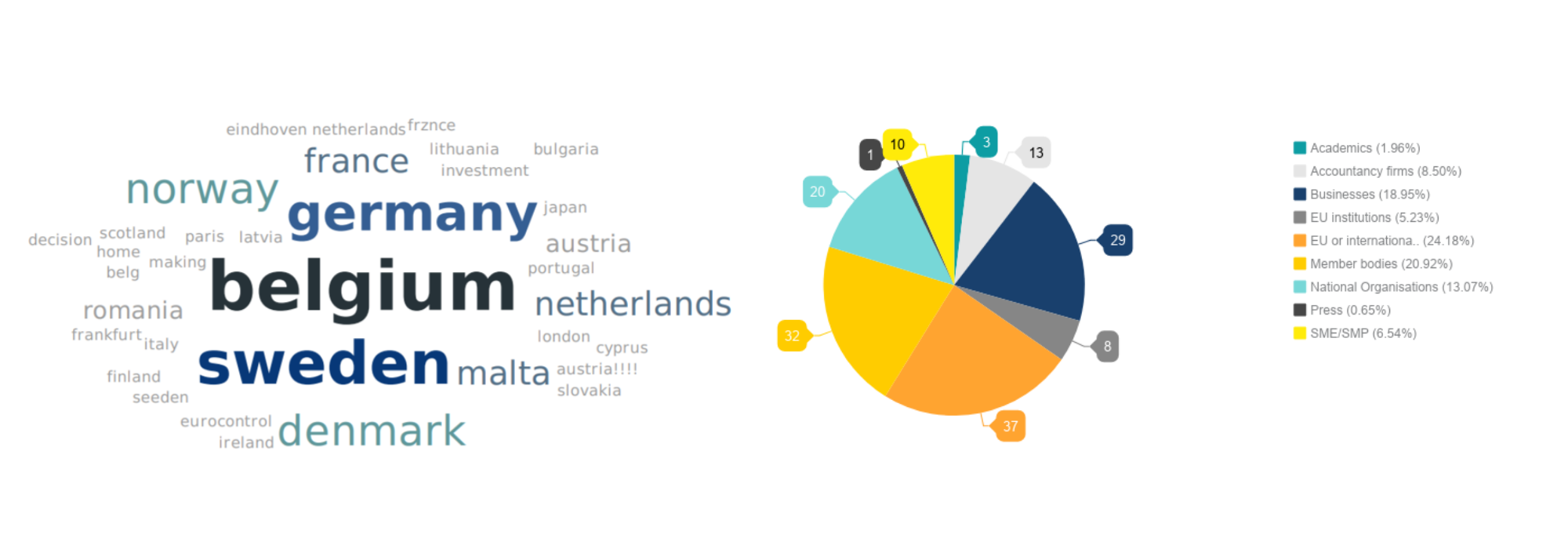

153 people from all over the world gathered in Brussels for this event: EU policy makers, business leaders, academics and regulators joined the profession to debate the impact of technology.

But how do professional accountancy institutes deal with digitalisation?

![]() of our members see technology as an opportunity to improve the profession’s services. Our Technology Barometer shows that they have a clear positive outlook for the future.

of our members see technology as an opportunity to improve the profession’s services. Our Technology Barometer shows that they have a clear positive outlook for the future.

Olivier Boutellis-Taft, Accountancy Europe CEO

Our keynote speaker Philippe Arraou kicked off the day by encouraging accountants to adapt to the ‘Revolution on Planet Accountancy’

|

|

|

|

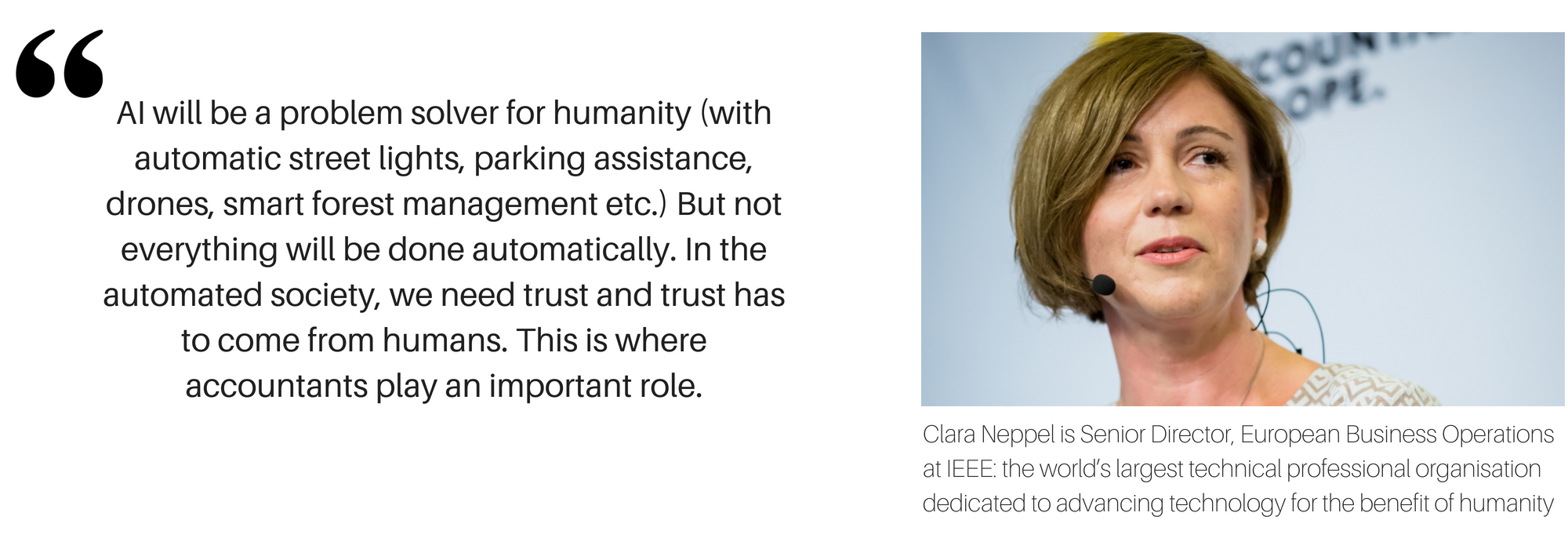

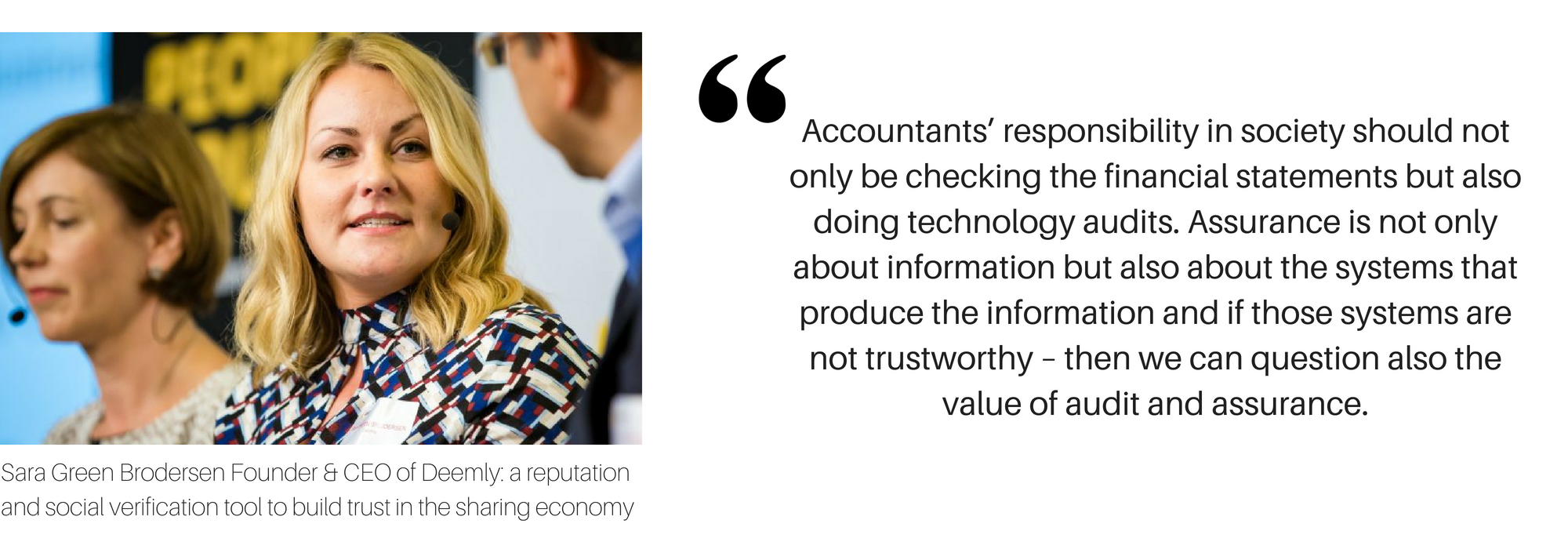

Trust and transparency are paramount for our digital society

Watch the full recording of the panel here

What was Twitter’s response to the speakers’ discussion?

|

|

After the lunch break, 3 sessions allowed participants to dive deeper into these areas

1. Audit & Innovation

|

|

Find the summary of this session here

2. Tax: harnessing the potential of technology

|

|

Find the summary of this session here

3. Accounting: Reporting from input to output

|

|

Find the summary of this session here

What did participants think of the sessions?

|

|

|

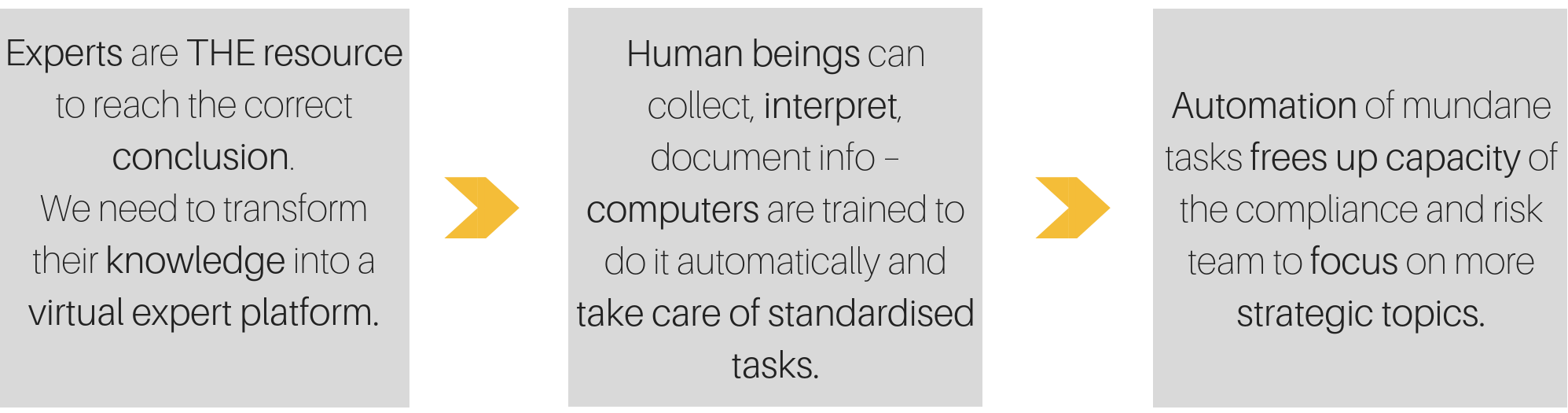

Our one-hour discussion highlighted how technological developments support regulatory compliance. We heard concrete examples of how AI, machine learning, robotics can offer solutions.

Kevin How, Alvarez & Marsal, Senior Director advises financial institutions on addressing a huge volume of complex regulations via technology. He derived the following advice from his experience:

|

Kasper W. Rost is the CEO & Founder at Calcabis, a Danish RegTech company focusing on using AI to optimise compliance and risk processes:

This builds on the basis of how accountants can benefit from RegTech as seen in our blog RegTech the next big thing? . It makes regulatory compliance easier, it can help detect real-time market or operational risks. It can also set up ‘know your customer’ procedures to aid due diligence and combat financial crime.

Olivier Boutellis-Taft, Accountancy Europe CEO |

Jyoti Banerjee, IIRC Programme Lead |