13 May 2019 — Stories

by Julia Bodnarova

Keeping our personal information private is a concern for us all. It’s been one year since the EU’s General Data Protection Regulation (GDPR) required all organisations processing data to review and adapt their documents and procedures. What the GDPR means in practice has been the topic of intense debate. In this blog, we aim to clarify what the GDPR means for auditors and accountants in their daily work.

For more in-depth information, see our position paper GDPR: implications for auditors.

For statutory auditors, safeguarding their clients’ personal data is crucial, as their independent expert opinion provides trust to our financial infrastructure. In forming an opinion on companies’ financial statements, auditors process private data on a daily basis and therefore, must comply with the GDPR.

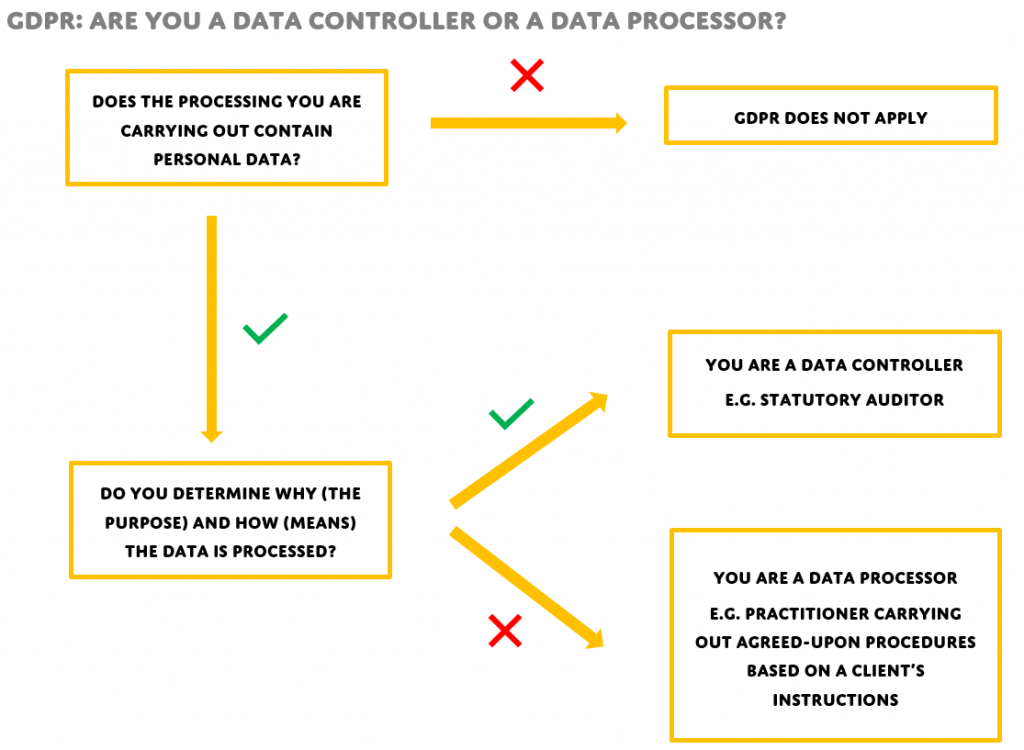

This is why statutory auditors need to identify which role they play under the new legislation: whether they are data processors or data controllers, as the responsibilities allocated to each role are different.

See the responsibilities for data controllers and data processors in our publication.

EU law requires auditors to be independent from their clients. This means that auditors determine why they need to use personal data and how this data is processed or stored. Because of this independence, auditors need to be considered data controllers under the GDPR.

In practice, this means that auditors need to set up a privacy policy to clarify their role and responsibilities as data controllers. They also need to notify their clients of this, by including a data protection clause in the engagement letter.

When not performing statutory audits, accountants should analyse the service they provide to determine whether they function as a data processor or data controller. They can do this by asking themselves: “as service provider, do I have any control over the purposes and the means of processing these personal data?”

If the answer is “no”, accountants and accountancy firms are acting as a data processor. In this case, they are acting on behalf and under detailed instructions of the data controller. For example, when clients control what, why and how accountants can process their personal data.

When practitioners are acting as data processors, they are required to enter into a data processing agreement with their clients, which must comply with the strict requirements of article 28 of the GDPR. They also need to clarify whether they are acting as a data controller or a processor in the engagement letter’s data protection clause.

However, there is one major caveat to this: whenever practitioners detect a malpractice which they must report, they will always be acting independently as data controllers for this specific purpose.

Check out our work on data privacy and GDPR.